Hundreds of powerful tools,

one CRM platform.

Discover the power of our CRM system, developed for debt collection agencies. Simplify your workflow with easy data import, one-click calls, and automatic debtor communication.

Discover the power of our CRM system, developed for debt collection agencies. Simplify your workflow with easy data import, one-click calls, and automatic debtor communication.

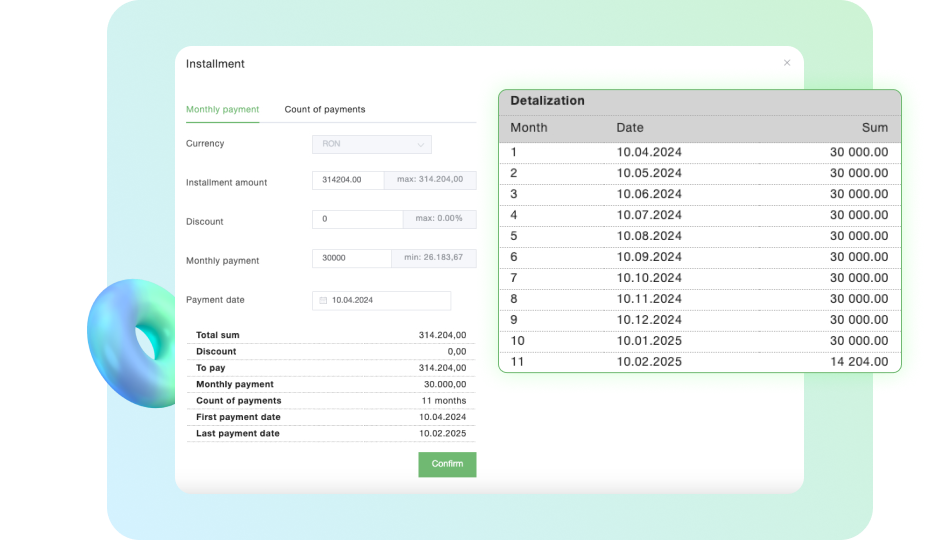

Offer debtors the option to divide their debt into more manageable installments. This flexibility can increase the likelihood of payment, improving collection rates and debtor satisfaction.

Also, you can calculate interest on a daily basis automatically to be sure that interest accruals are accurately captured until the debt is fully paid.

Connect with debtors directly through our one-click dialing feature. This integration enables operators to initiate calls within seconds, enhancing productivity and communication with debtors.

Incoming calls are automatically match to debtor cases based on the phone number, ensuring that operators can access relevant information swiftly during calls.

Multi-factor authentication via Okta provides an additional layer of security by requiring more than just a password for user authentication. This significantly reduces the risk of unauthorized access.

integration simplifies the management of user identities and access across the system, enhancing control over information access.

Prevent off-hours access with the scheduler. It restricts login to the CRM system outside of designated working hours in compliance with data protection regulations and internal policies by enforcing controlled access based on time-based rules

Allows access only from specific IP addresses, for using the system from secure and approved locations. It gives additional safeguarding against unauthorized access attempts.

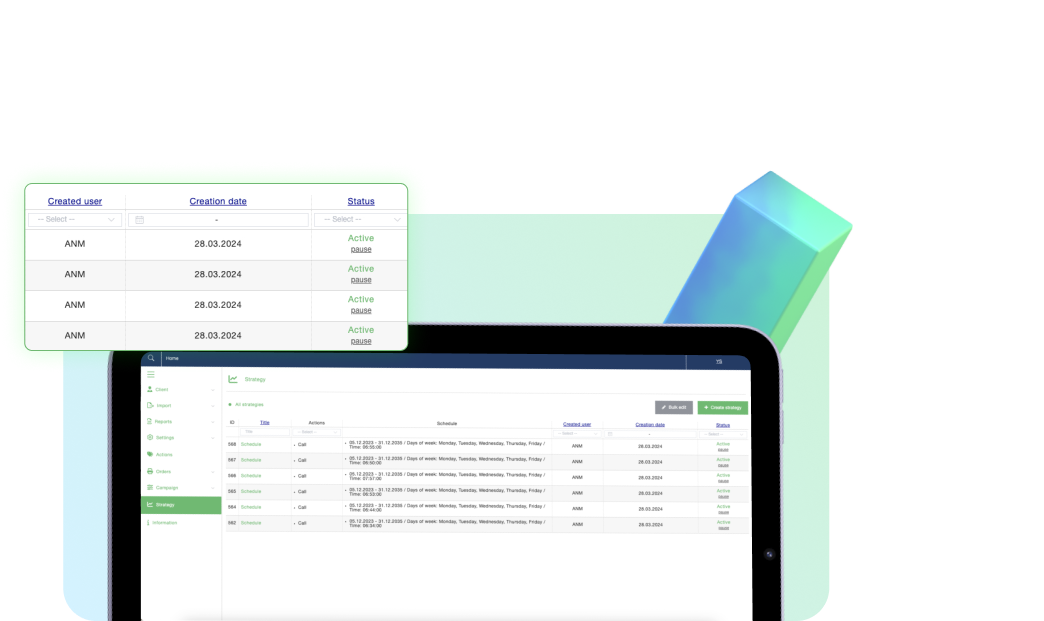

Set up automated recurring events to send emails, and SMS messages, or perform other activities at planned date. Automation enhances engagement by ensuring communications are timely and relevant.

Close cases automatically when debts are paid. This feature streamlines case management and ensures that the system reflects current information, reducing manual oversight.

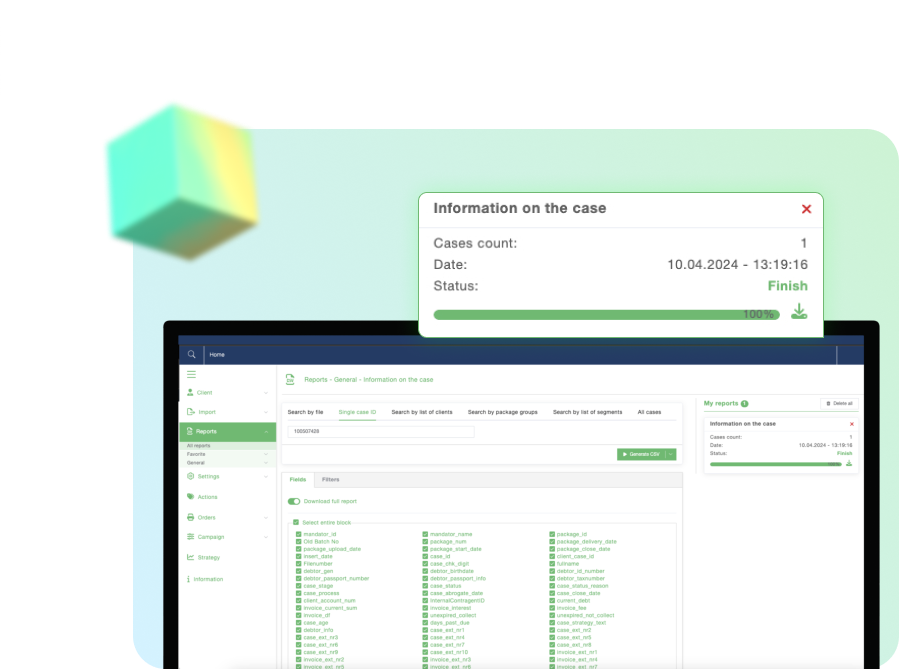

Generate detailed reports on case activities, operator performance, or payment collections.

Provides insights into operational efficiency and outcomes, enabling data-driven decision-making.

Send SMS messages, emails, or letters to debtors in a few clicks, facilitating efficient communication and informing debtors about special offers or payment information.

Maintain a comprehensive record of all interactions with each debtor, including calls, emails, and SMS messages. With activity history operators will be fully informed about past communications, activities, and other interactions with the case.

Easily upload debtor data including phone numbers, addresses, names, and outstanding debts into the system with imports.

This streamlined process ensures that all necessary information is at your fingertips, facilitating efficient case management and avoiding adding information manually step by step

Attach any document to debtor cases and automatically generate document packages based on the attached types. This organization tool makes document management more efficient and easier to maintain.

Search cases using any parameter, such as phone number, debtor name, or case status. This functionality ensures that information is easily accessible, enhancing operational efficiency.

Utilize a scoring system based on debtor activities like promises to pay and actual payments to focus efforts on the most promising cases.

Group cases by tax or phone number to identify all debts associated with a single debtor. This feature helps you to collect all debts for a single debtor in one place.

Organize tasks into boards (To Do, In Progress, Done) for task assignment and progress monitoring, promoting team productivity.

Manage your lists of legal documents, mark the uploaded documents as done, and make an archive. It simplifies preparing for the court process and minimizes the risk of overlooking crucial documentation.

Automatically retrieve and update debtor credit history, providing valuable insights for decision-making.

Check the existence of email addresses and phone numbers before communication, improve your success rates, and reduce costs.

Facilitate debt closure from any location with instant payment processing, enhancing debtor satisfaction and trust.

Import data from external data sources directly into your database. Reduce manual entry errors with more efficient debtor information management.